Strategies

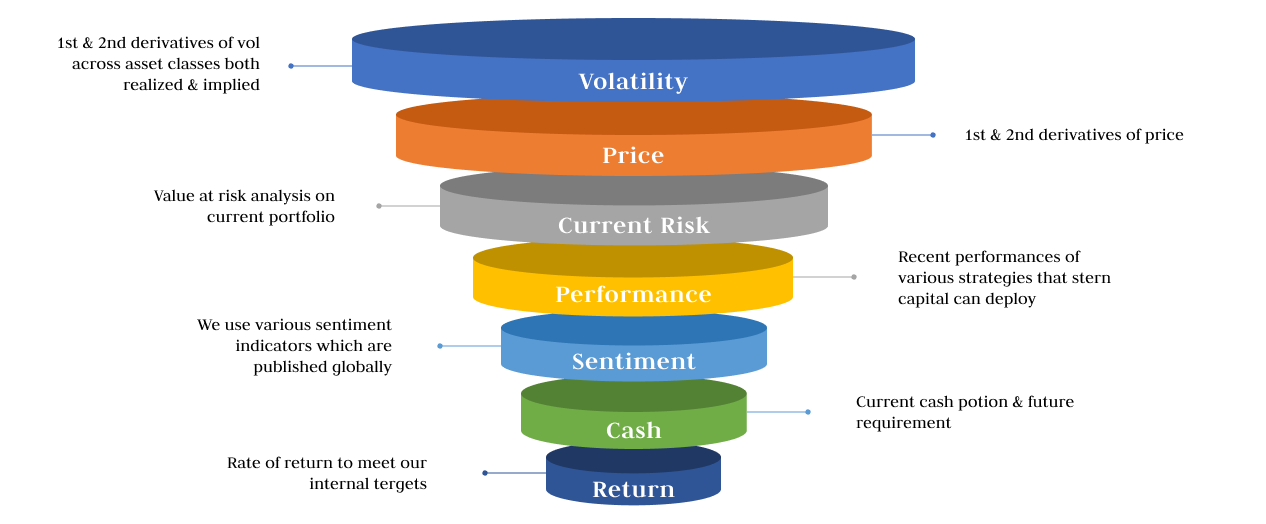

CAPITAL ALLOCATION MODEL

Stern Capital has a systematic, rigorous and disciplined process that monitors global performance in real time and uses proprietary seven factor model to determine capital allocation

QUANT EQUITY STRATEGIES (QES)

Our Quant Equity Strategies capitalizes on single-stock price momentum, reversion characteristics, and deviations from fair value over time. Using proprietary models to forecast prospective single-stock dynamics using quantitative factors, QES seeks to dynamically manage in real-time, while accounting for risk and trading costs, a balanced and optimized portfolio of long and short listed equity positions.

Momentum

Forecasts future returns based on a proprietary Multiple-Regression Kalman-Filter model

Mean Reversion

Forecasts future relative-returns using regressions and ADF-tests to identify mean-reverting pairs and groups

Low Vol Factor

Forecasts future relative-returns using a proprietary version of the “Low-Vol” anomaly

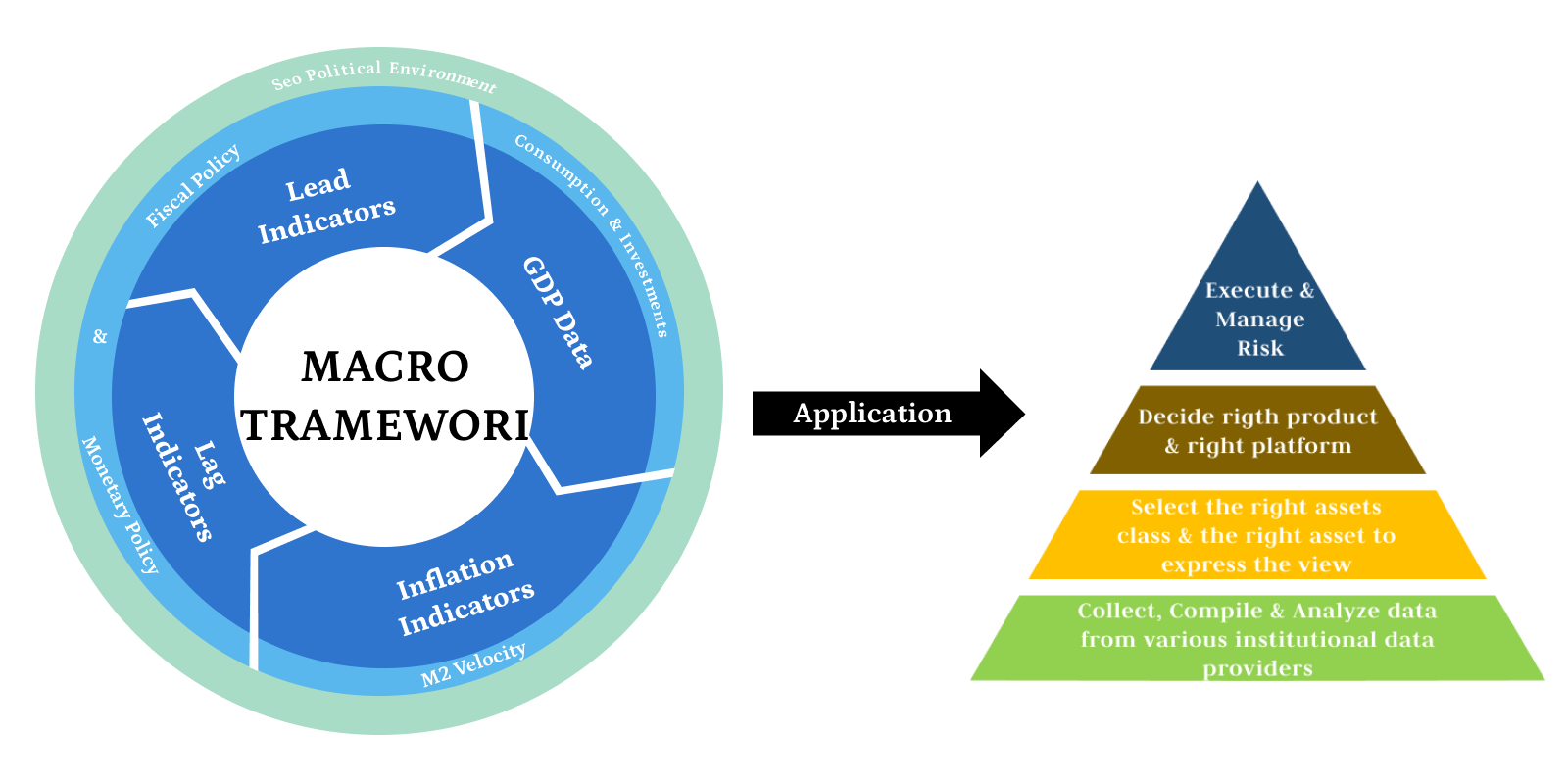

MACRO STRATEGY – FRAMEWORK & IMPLEMENTATION

Through the Macro Framework the team at Stern monitors activity in real time Globally

QUANT OPTIONS STRATEGIES (QOS)

Our Quant Option Strategies capitalizes on mispricing in index and single-stock options. These are identified using implied and realized volatility, term structure, skew, price momentum, reversion characteristics, and deviations from fair value over time.Using proprietary models to forecast prospective index and single-stock dynamics using quantitative factors, QOS seeks to dynamically manage in real-time, while accounting for risk/greeks and trading costs, a balanced portfolio of long and short listed option and equity positions.

Vol Long-Short

Uses proprietary models to forecast prospective single-stock dynamics and corresponding option prices

Vol Dispersion

This strategy evaluates single-stock option prices relative to equity index option prices

Vol Skew

This shorts options on large-cap stocks against long index-option positions